PSF Shows Weak Conditions This Summer

Author: May 18, 2012 16:13

|

168tex News: The inventory of crude oil in the United States had created a new high since 22 years, which opened the gate of continuous drop in the oil prices. It dropped 10 dollars and fell more than 8% in recent five trading day. Recently, the continuous drop of international oil prices made the prices of polyester raw material market sign, which intensified the weak trends of the polyester staple fiber.

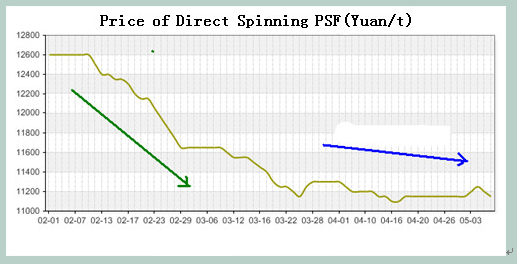

Firstly, we knew that the polyester staple fiber had stayed at the bottom of market since this year. In addition, the market price of PSF was wandering about the cost line nearly two months (as the following chart shows). Ended by 10th May, the leading quotations of 1.4D direct spinning PSF focused on 11,050-11,150 Yuan/ton in East China, which dropped nearly 2,000 Yuan/ton and the fell reached to 15.15% year-on-year.

Secondly, we specifically analyzed the influence factors of polyester staple fiber in recent stages.

a) The oil prices plummeted and the cost support weakened.

Restricted by the Iran crisis and supported from the continuous good economic data, the international oil prices had been strong since the price of crude oil in the United States stayed at 100 dollars/barrel again. However, because the investors were worried about the recent debt crisis in Euro zone, it prompted the wide selling in commodity future market. Therefore, the demand prospects of global crude oil began to muddy and the future prices of international crude oil continued to be weak. It fell 8.6% in the past five trading days. Closed by 9th May, the future prices of light crude oil delivered in June in New York Mercantile Exchange (NYMEX) closed at 96.81 dollars/barrel, which had created the lowest closing price of main contract since early February.

Affected by the slumped international oil prices, PX and PTA all showed the weak tendency, which made PSF have less supporting effect in cost. We could conclude that PSF price kept firm in previous stage, which mainly thanked to the cost supporting of raw material. The train of hurdles directly impacted the market movements of PSF.

b) The export reduced and the demand weakened.

Due to the weak demands in the downstream, PSF was difficult to be strong. According to statistics, ended by the close of the 111th Canton fair, the transaction volume rarely declined. Although the number of purchasers reached 210,831 in this Canton fair, which increased 0.179% compared with the previous session and set a new record again. However, the total export turnover was 36.03 billion dollars, which dropped 4.8% quarter-on-quarter and fell 2.3% year-on-year. According to the data released from all previous Canton fair, this year’s decline in turnover was very unusual in history expect 2008 when financial crisis happened.

The terminal demand was hard to increase and the orders of downstream manufacturer were not improved, which made the downstream yarn market confused. Among which the price of 100% polyester yarn was mainly in consolidation. Although the fall of product price was not great in previous times, the actual demands were insufficient in downstream enterprises and the inventory pressure in the yarn manufacturers was still great. So the mood of yarn manufacturer tent to be cautious and the purchasing intention of PSF also weakened.

c) Supply exceeds demand and cotton price is suppressed.

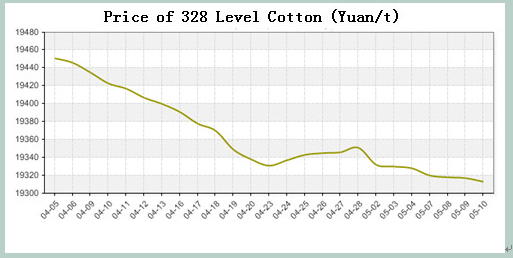

Recently, the cotton price also declined and the market transaction was mild. It was well known that the price gap with cotton was an important factor that impacts the prices of polyester staple fiber. Therefore, the continuous drop of cotton price also brought some difficulties for the market of PSF. See from the dynamics of domestic cotton market, recently, CC Index 328 decreased to 19,317 Yuan/ton, and CC Index 527 also fell to 16,795 Yuan/ton. Due to the uncertainty of external economic market and Indian government re-opened the cotton exports, which caused the global cotton supply increased. The cotton market became oversupply and the price was suppressed.

Generally speaking, the supportive power from upstream cost side was weakened. In addition, the downstream demands were so soft that PSF price showed weak conditions in this summer. It is expected that PSF will be weakly adjusting in a near future.

|

Editor: sunny From: 168Tex.com

Most Read