When Could be the Brilliant Situation for PTA?

Author: Feb 24, 2012 09:57

|

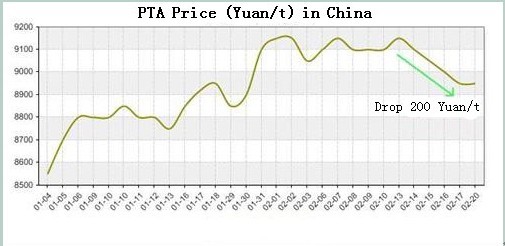

PTA price declined 200 Yuan/ton from February 13th-17th, 2012, and currently the PTA price was lower than 9,000 Yuan/ton. It was well known that PTA price was affected by two major factors, which included high costs and soft demands. While it compared with the costs in recent times, and the demands got the upper hand, so PTA price continued to decrease. In that way, Whether the PTA price could increase again or not, the author would analyze from the costs and demands. The details were as follows:

Firstly, as the upstream raw material of PTA, PX price kept a higher price due to the expensive crude oil, and PX device need to examine and repair at the beginning of this year. The production capacity of PTA began to expand and made PX supply was tight, it was inevitable that PX price kept strong. In recent times, although the weak demand led the whole industry chain slump in the terminal market, PX price still maintained 1,600 U.S. dollars, and it formed a considerable cost pressure for the PTA plants. Moreover, the upstream PX would be the high cost in a long term, so the supporting function of cost was still obvious.

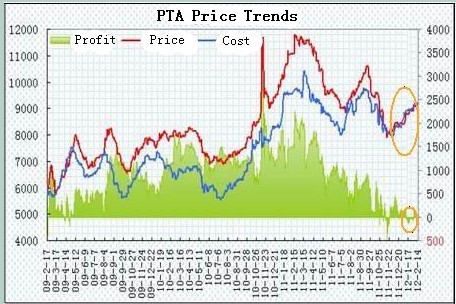

According the spot goods to calculate, at present PX price was 1,602 U.S. dollars (FOB Korea) in Asia, PTA spot price was 8,950 Yuan/ton in domestic market. According to investigation, the processing cost of PTA was around 900-1200 Yuan/ton due to the different production capacity and management fee, at present PTA profits was close to its costs and even to loss. So that the PTA downward space was limited, and there was no any reason to decline substantially in the market.

Secondly, now the order issue was one of the biggest problems in terminal market, and the textile enterprise generally reflected lack of orders. Therefore, it led the inventory pressure increased for the polyester manufacturers. According to the investigation and statistics, the inventory of polyester POY was about 15-18 days, FDY was more than 20 days, and DTY was about one and a half months. Some polyester plants had to cut the price in order to receive cash, and it restricted the purchasing intention. In addition, along with the supply of PTA loose and loss increased, and the downstream polyester manufacturers preferred to buy PTA in domestic market, made the PTA imports reduced, and it also restrained the PTA future price.

What’s more, the mainly reason was insufficient foreign demand. It was affected by the slow economic growth in Europe and the United States and intense competition with the neighboring countries, our country's export situation was not optimistic, and the exports declined substantially. According to the monitor data from General Administration of Customs, our total exports of textile & garments reached 21.519 billions in January, fell 0.42% year-on-year, this was the first negative growth after the financial crisis, meanwhile, the textile exports dropped 6.80%, garments and accessories increased 3.51% and shoes declined 1.3%.

Generally speaking, the cost was still strong. PTA price gone weak, and the mainly reason was the sluggish demands, and the order issues were the biggest problems. Through the usual experience we could know that the peak season of textile would come, and the PTA sales would improve.

|

Editor: sunny From: 168Tex.com

Most Read