Poly Filament Fiber: Quotation Come Back to the “Crossing”

Author: Jun 27, 2011 13:57

|

Into mid-June, the bull market of poly filament yarn in the first half of June died down. Its price has consolidated for about 10 days. Under the circumstance of no favorable factors to go up, the production and marketing rate of the poly fiber spinning plants lowered down. Mostly the rate was at 60%-70%, few was at 80%-90%, and few was at 40%-50%. Inventory was mounting up in the warehouse. When will be the end of such a market situation? And what’s the market situation will be in July? Now I will combine the fundamentals, illustrating my point of view as follows:

1. The macro fundamentals sense danger every where

The central bank announced that from 20th June, deposit reserve ratio was going to be raised, which was the sixth time of the central bank to raise its deposit reserve ratio of this year. After the adjustment, the reserve rate will reach 21.5%. According to survey, the freezing funds was raised 380 billion dollars, reduced bank’s net interest income of about 5 billion. 21st June, 1 year central bank bill interest rate rose as expected, by 21st June, market funds face further drought. Moreover, commercial banks are suffering the mid-year assessment pressure, the tension situation will continue for some time. Official of NDRC price department stated, for commodity inflation, the June commodity price level will generally higher than that of May, which will hit the peak of 35 year ever since. That further arouses the expectation interest raise. Under such a tightening monetary policy, middle and small sized enterprise will suffer the most。 The direct consequence of cash flow difficulty is the shutdown of factory with high material cost and low products price. Currently, such kind of circumstance has emerged in some areas, which can not be looked down.

2. Material price is weakened

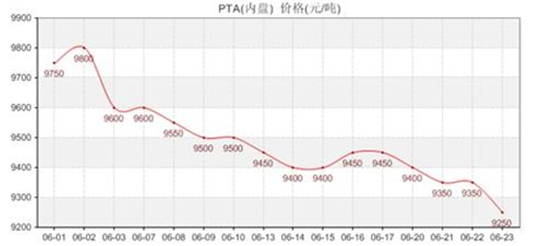

23rd June, PTA futures price continue to slump. The main 1109 contract closed at 9058CNY finally, dropped greatly by 172CNY in compare with the previous day. On spots, PTA quotation in China dropped slightly, suppliers’ quotation dropped to 9350CNY, and on dollar quotation, the Taiwan ship loaded cargo was quoted at $1190, Korean goods quotation was quoted at $1180, the market trade atmosphere is cold. The currently PTA equipment come into production, adding new production 160 thousand ton every month. Moreover, Dalian PTA plan to expand its production by 500 thousand ton per year in July. PTA production enlargement program is also carried out in other place of Jiangsu province. The over supply of polyester material may bring about disadvantage factor to its price.

3. Terminal industry situation is unfavorable

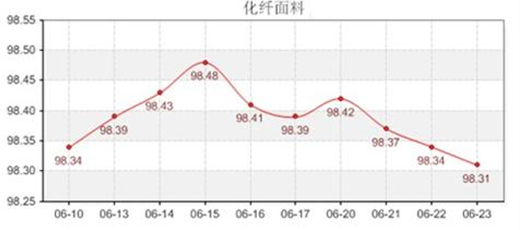

According to Chinese Customs statistics, from January to May, 2011, China’s textile and garments export amount is accumulated to 88.835 billion dollar, which increased 26.55% compare with that of last year. Counting on RMB appreciation, material price and labor cost increase, the actual order amount increase is quite limited while export amount in May is apparently slowed down than that of Jan, Mar and Apr. It is said that the 20%-30% price increase is generally unacceptable by foreign buyers. Some European and American buyers are reducing procurement amount from China, and the low end products will transferred from China to Southeast Asian counties. In addition, according to the commerce department China, silk and chemical fiber index data, recently the fabric sale is not optimistic (see the following graph). Fabric industry is the subordinate industry of polyester filament industry, as the fabric industry decays, the poly industry will decay following up.

4. Polyester enterprise pressure is not big.

After the price increase and stock remove in June, now the polyester plants operation situation is relatively healthy. Even under the circumstance of stock mount up, capital flow of the poly plants is not influenced. In such a situation, the prior strategy is to reduce price fluctuation and ensure smooth products delivery. See from this, poly plants will not increase its products price, except for short supply products.

To sum up, unfavorable factors get the upper hand of the whole poly market. For the fourth factor can better decide the market trend, the stalemate situation will be continued in a short term. As to when the stalemate situation will be broken, I am afraid it will be not until the day of supply and demand unbalance, or under the situation of forceful outer factor and maybe the load shedding program that the high temperature brings about will become the trigger. All in all, polyester filament fiber market situation in July is quite unoptimistic.

|

Editor: Candy From: 168Tex.com

Most Read