Analyzing the Operations of Nylon Industrial Chain from the Aspect of Cost

Author: Mar 08, 2013 09:08

|

Recently, the upward trend of pure benzene slows down in the market, but the upstream raw material CPL still keeps firm, which provides the cost backup for nylon market. CPL price declined after rose in late Feb. the price stabilized at 20,100 Yuan/ton, while the price of conventional spinning nylon chip was about 21,500 Yuan/ton. Under the support of cost, the price of nylon yarn increased slightly. Therefore, how nylon price will behave in aftermarket? From the viewpoint of price gap, this paper analyzes the profits of nylon products since Feb. to know about the operations of whole nylon industrial chain.

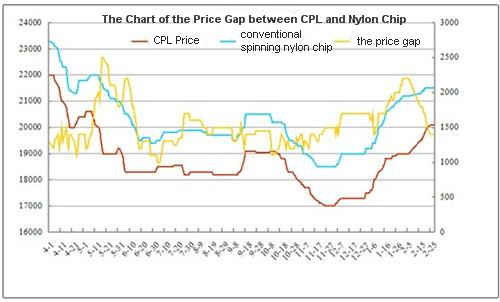

The price gap between CPL and conventional spinning nylon chip

CPL price has followed the upward trend since Feb. The price went up from 19,000 Yuan/ton to current 20,100 Yuan/ton in domestic market, which rose 1,100 Yuan/ton. Recently the inventories in CPL factories are on the low side and the market supply seems tense. It is predicted that CPL price may still keep firm in aftermarket.

As for nylon chip, the price trend of pure benzene goes slow and the supply of raw material is insufficient. The high price makes the price of nylon chip difficult to change. Among which, the price of conventional spinning nylon chip in East China ascends from 21,200 Yuan/ton to 21,500 Yuan/ton, which rose 300 Yuan/ton. The purchasing moods of the manufacturers are still hesitating. It is predicted that the resistance of the chip price to go up will increase in aftermarket.

As for the trend of the price gap, it slides to 1,400 Yuan/ton in current period. At present, the profits of conventional spinning nylon chip manufacturers drop sharply and they have great losses. Now the operating rate of the chip manufacturer focuses on 70%-80% and it even reaches to 90% in 75% enterprises. The inventories in some enterprises are around 10-15 days. Now the production and marketing of the chip is insufficient and the transactions are cautious in the market.

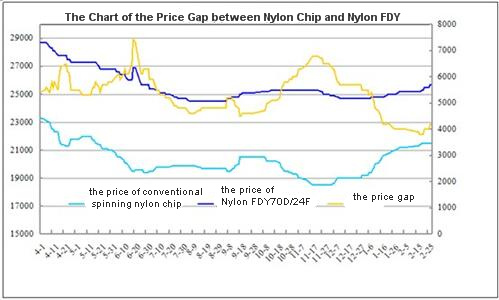

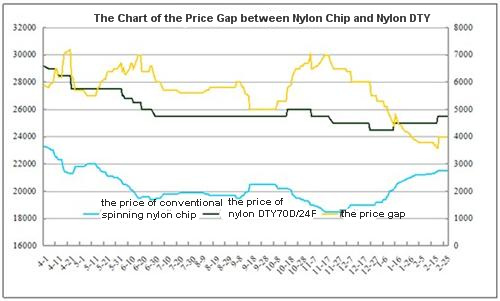

The price gap between conventional spinning nylon chip and nylon yarn

The prices of nylon products basically increase after the Spring Festive and the cost of nylon yarn climbs affected by upstream raw material. The prices of most FDY, DTY and POY products show upward trends in current period. Now the price gap between FDY70D/24F and conventional spinning chip climbs slightly, which picks up to 4,000 Yuan/ton, but it is still in the red. Moreover, the price gap between DTY70D/24F and conventional spinning chip still remains at 4,000 Yuan/ton, which is subject to the losses as well. Under the great support of cost, the price of nylon yarn rises slightly. In addition, the market demand is expected to follow in succession, so the profit may pick up gradually in the short term.

As for the aspect of inventory, now the whole inventories of nylon yarn are around 20-30 days, which keeps stable compared with the early days. Besides, the operating rate of civilian nylon manufacturers returns to the normal level of 80%-90%, while it is still around 60%-70% in non- civilian yarn market. The operating mood of the nylon manufacturers picks up to the normal level, but the upward trend begins to slow down due to the insufficient demand in terminal market. However, the demand may be improved further in the future and the sales stably increase in downstream nylon fabric market. It is predicted that the price of nylon yarn may continue to go up under the cost pressure.

To sum up, CPL price and chip price both go up cautiously. Under the cost support, the prices will still keep firm in the short term. Along with the coming of traditional textile peak season, the orders will increase gradually and the purchasing moods of the buyers will be improved further. Therefore, it is predicted that the price of nylon yarn will keep stable and show slightly upward trend in aftermarket.

|

Editor: tina From: 168Tex.com

Most Read