PTA: When will be the end of dropping?

Author: Mar 07, 2013 16:15

|

In recent half month, PTA futures showed great slumping performance. The present PTA futures price has dropped to the 8,000 Yuan/ton in the market and the decreasing rate was 8.30%. Influenced by the weak performance of PTA futures, the spot price also showed sliding tendency, which has already decreased to 8,150 Yuan/ton by now and dropped almost 700 Yuan/ton with half month. The continuous drop of PTA futures is mainly caused by the unfavorable factors.

First of all, as for the PTA market itself, the continuous slide of PX price led the cost supportive effect weakened for the PTA. Along with the weak demand, PTA spot price showed great slump, the manufacturers faced great deficit and the operating rate dropped from 77% before the Chinese New Year to 66% by now. Meanwhile, in order to avoid the overmuch deficit, most manufacturers began to shut down and have turnaround for the PTA plants. For example, Ningbo Taihua planned to expand the capacity of its PTA plant in March and will shut down for 3 weeks. Taiwan Yadong Petro-chemical stopped a set of 450,000 ton PTA plant on March 2nd and will restart on March 12th. Jialong Petro-chemical will decrease the load of the PTA plant to 85% this month due to market reasons. A set of 900,000 ton PTA plant will also have turnaround this month in South China.

Secondly, judged from the PX, the upstream feedstock of PTA, since September last year, PX had been a strong factor that supported PTA price to go strong. However, after the Chinese New Year, PX market continued to perform unstably, and its supportive effect for PTA also weakened. Especially in recent weeks, PX price dropped dramatically. On March 4th, Asian PX price dropped 79 dollars to 1,507 dollars/ton FOB Korea and 1,532 dollars/ton CFR China. The weak performance of PX market undoubtedly became a vital shock for PTA prices. Hence, under weak upstream PX market, PTA price is hard to turn upward in a short term.

Thirdly, the polyester market. Influenced by the weak PTA and MEG market, polyester yarn products kept performing stably. However, due to the slump of recent PX market, the market confidence was shocked and the polyester yarn price began to drop from March 5th. The decreasing rate was among 100-300 Yuan/ton in most regions. For example, POY 75D/36F and 150D/48F was quoted around 11,600-11,900 Yuan/ton and 11,450 Yuan/ton respectively. DTY products dropped 100 Yuan and FDY products dropped 300 Yuan/ton in one of the manufacturers in Xiaoshan, Zhejiang Province, which quoted FDY 300D/96F at 11,900 Yuan/ton. Another manufacturer decreased POY products by 100 Yuan/ton and quoted POY 100D/144F and 150D/144F at 12,000 Yuan/ton and 11,550 Yuan/ton respectively.

The following form is the price change of polyester products on March 5th.

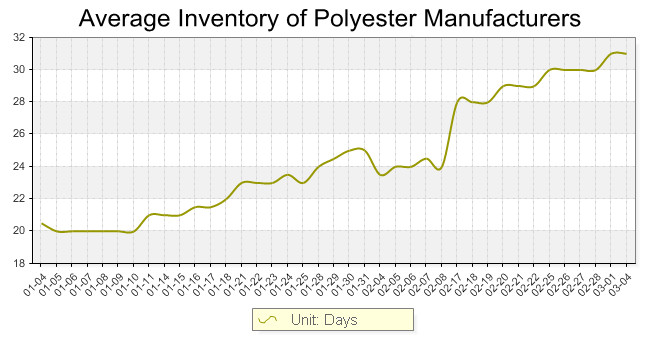

Fourthly, the polyester inventory increased. Although the Chinese New Year has passed for more than half month, the downstream polyester market was still mild and the production-marketing was only around 50-60%. Besides, the inventory of polyester manufacturers kept increasing greatly. According to the data from China Textile Suppliers, the present polyester POY stock was around 25 days; FDY stock was around 37 days and DTY stock was about 26 days. The polyester yarn inventory was getting close to a historical high level. The present gray fabric inventory in Shengze, Jiangsu province was around 36 days and the higher was reported at 40-42 days. The high inventory greatly affected the manufacturers’ demand for the feedstock.

To sum up, both the cost side and the demand side was unfavorable for PTA market. Therefore, PTA price may keep dropping in the near future.

|

Editor: emma From: 168Tex.com

Most Read