The Market Review and Outlook of PTA in 2012-2013

Author: Jan 08, 2013 15:14

|

Firstly, the pace of progress was staggering in 2012.

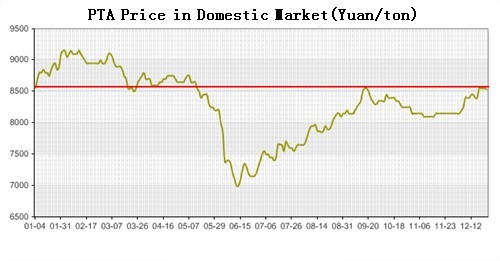

In the competition of the upstream raw material PX and downstream demands, PTA was hard to break through and presented a shape of “V” all year round. See from the price trends, the spot price of PTA changed radically in 2012, which increased to the highest point of 9,150 Yuan/ton by the end of January and then fell to the lowest point of 7,000 Yuan/ton in the middle of June. However, PTA price was back to the level of early this year of 8,500 Yuan/ton in December. The specific analyses of PTA price trends were as follows:

As a whole, PTA price rose sharply in January. The main reason was due to the continuous good news from America economic data and the rising price of crude oil. PX price rose at the rate of 15 dollars each day. The strong price of PTA was driven by many positive factors and it had risen to as high as 9,150 Yuan/ton.

Owing to the collapse of the crude oil price, PTA price rebounded back sharply in May. Meanwhile, it was affected by bad news of the sluggish demands in downstream market and the arrival of off season in textile industry, PTA price dropped into the bottom and the spot price fell to the lowest point of 7,000 Yuan/ton.

The adjustment of PTA price shocked in October, November and December. Under the background of the slowdown of foreign economy, the drop in the growth rate of the textile and garment market at home and abroad and the increasing new capacity, the strong price of PTA and the downstream polyester was hard to support finally. However, due to the influence of the strong upstream raw material PX, PTA price was out of the weak situation and showed the rising trends in December. Therefore, the spot price of PTA was back to the level of early this year.

According to the review of PTA in 2012, it was influenced PTA price by two major factors. Owing to the sluggish demands in the downstream, the negative growth in the textile industry and the collapse of the crude oil price in the first half of this year, PTA price declined sharply. In addition, PX price greatly picked up under the situation of supply tight, so the cost support of PTA was very strong and the price continued to go high in the second half of this year. Therefore, PTA price was driven by the demands in the first half of this year, while it was pulled by the cost in the second half of this year.

Secondly, the road to recovery would be a long one.

In the aspects of the cost, due to the supply tight, the raw material price of PX in 2012 continued to high. The profits of MX plus PX went as high as 500 dollars/ton, which reached a peak over the past decade. As for the new capacity in 2013, the capacity in Dragon Aromatics Co., Ltd. was 800,000 tons/ year that would put into the market by the end of the first quarter of 2013, the capacity of Korea’s Hyundai and Japan’s Cosmo Oil was 800,000 tons/year that could also put into the market in January 2013, while the time of other new capacity was uncertain. It was reported that most of the device won’t put into the capacity in advance. From this we can know that the new capacity is still limited in 2013 and the gap between the demand and supply will further enlarge.

In the aspects of the demands, there was no increase on the production of polyester filament yarn in 2012. It calculated that the production of the polyester filament yarn was 19 million tons in the whole year of 2012, fell 0.1%. Because of the export difficulties in the downstream textile industry and the high inventory of fabrics and garments, the capacity appeared the stagnant conditions. The export of Chinese textile industry was negative growth in the first half of this year and improved until the second half of this year.

Generally speaking, there will be a rise space for PTA in the first half of 2013. Along with the new capacity of PX in the second half of next year, PTA price may be back again and the road to recovery will be a long one.

|

Editor: sunny From: 168Tex.com

Most Read